Semiconductor

TSMC’s 5nm process out of stock for Kirin 9000, Huawei’s contract loss costing big to Taiwanese chip maker

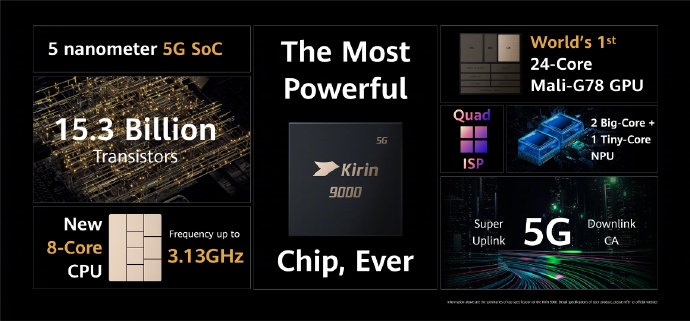

Huawei is the second-biggest customer of TSMC (Taiwan Semiconductor Manufacturing Company) after Apple. With the deadline of September 15, 2020, Huawei’s Kirin 9000 processor was out of print TSMC 5nm process.

According to the latest news, TSMC has been unable to resume Huawei, which surely leaves a big impact on it. This year Huawei is also one of the two largest customers of 5nm technology and it is a regret for TSMC to lose Huawei.

As per the official financial report 2020, the revenue percentage collected from mainland customers has dropped from 22% to 5%.

Additionally, due to the global semiconductor production crisis in 2020, TSMC’s performance has increase,d and reported annual revenue of 1.34 trillion Taiwan dollars or about 309.9 billion yuan, which accounted for year-on-year (YoY) growth of 25%.

The report says the out-of-the-stock crisis in 2021 will not completely be resolved. In this line, TSMC has leveled up its prices many times and revenues in 2021 will also rise sharply with an expected increment of 20%.

Moreover, at the moment TSMC has no shortage of mature processes customers but the main customers of advanced processes mainly 5nm are temporarily only Apple. This loss of the major buyers like Huawei to share the depreciation of 5nm equipment has led to increased cost pressure.

Regarding this, TSMC has recently announced a three-year plan with an investment of 100 billion USD to significantly increase capital expenditures, which will also cause the company’s profitability to temporarily decline.

In the recent past, Capital Market has published a statement that TSMC’s stock price has fallen for three consecutive days below the 600 NTD mark because the market expects TSMC’s gross profit margin to fall below 50% in the future.

Aside from this, TSMC’s 5nm process is currently the most advanced but there are many possibilities that other manufacturers will definitely give tough competition to it. And the most certain is Ryzen AMD’s Zen4 Processor.

Following some sources, it is expected that Zen4 will arrive somewhere in 2022. Adding to this, it was reported that after Huawei’s 5nm production capacity was vacated, Zen4 ’s progress would be advanced to 2021.

Furthermore, at present, it observed that AMD doesn’t have further advanced plans. The new product of 2021 will be 7nm and also the rumored Zen3 or Zen3+.

(Source: ithome)