News

Huawei is working on chip making ability, will take time: TSMC

On 14th October the Taiwanese Semiconductor firm- TSMC released its 2021 Q3 financial report announcing revenue of NT$414.67 billion (around US$14.8 billion) with a net profit of NT$156.26 billion (around US$5.56 billion). Now, the company has registered a year-on-year increase of 16.3%.

According to the report, the company performed well in this quarter with a slight increase of 16.3% in overall revenue. In addition, the company also responded to the questions about Huawei‘s chip inventory establishment. But before that, let’s take a look at the report’s major points-

TSMC 2021 Q3 Report: Key Insights

- The quarterly revenue was expected to be between 14.6-14.9 billion US$, which is as expected- 14.88 billion US$

- The gross profit margin was expected to be between 50% – 51.5% that is recorded 51.3%

- The operating profit margin is expected to be between 38.5% and 40.5%, which is higher than the expectations- 41.2%

Also Check: Chipmakers TSMC and UMC continue to rise: Report

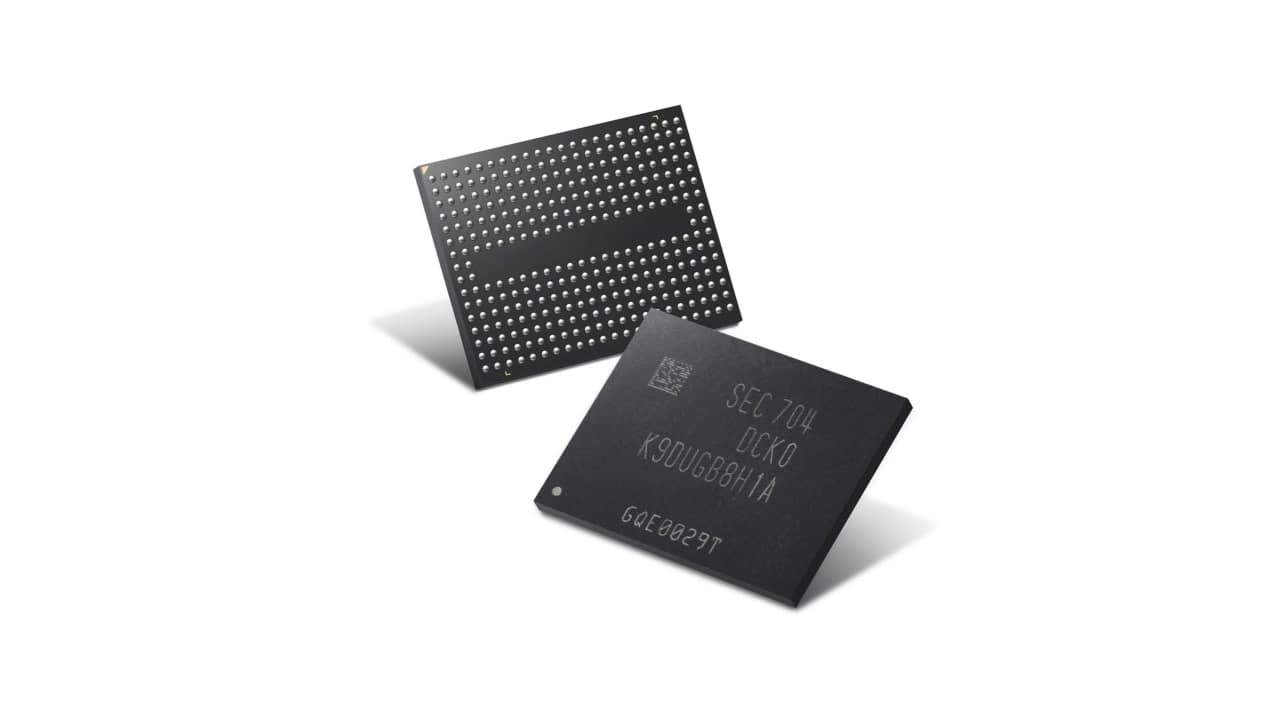

Particularly, the 5nm chip shipment contributes a total of 18% in the revenue. However, the 7nm semiconductor technology takes on the beat with 34% shares. Meanwhile, the more advanced technologies than 7nm, estimated 52% of total wafer revenue.

Besides, TSMC also expects to maintain the same performance even higher for the next quarter after evaluating the 2021 Q3 report. In the next quarter, the company mainly focuses on the 5nm technology which is currently in high demand.

TSMC’s Response to Huawei’s inventory Correction Planning:

While asking about Huawei’s inventory correction planning, TSMC responded- this Shenzend-based firm is currently focusing on its production capability and gathering more resources. Although it’s planning to review its strategies, it’s far behind to affect TSMC.

To be mention, the Chinese technology provider previously stated about keep nourishing its chipmaking subsidiary- HiSilicon. The company lacks RF front-end technologies for manufacturing the 5G chips. Still, it’s making further plans and hiring new talents to seek possible alternative solutions.

(Via- Mydrivers)